"AlignAlytics dont just provide data and analytics solutions. They are true problem solvers. For me their key offering is less the toolset they have developed (which is exceptional), it is more their approach with the client that really engages around the problem and works with them on potential solutions. They are full of ideas, wisdom and experience and are not afraid to challenge assumptions and approaches. They do all of this with velocity. These elements all combine into a high value add engagement proposition.” – Steven T, Global Head of Transformation

We have a proven track record of solving business-critical problems through our expertise in Commercial Analytics. Over the years, we have developed, honed, and focused on high-impact solutions for pricing, competitors, customers and true profitability.

AlignAlytics delivers commercial outcomes — not just data — turning analytics into real business value.

This is what we do. And have been doing for over 20 years.

ABOUT ALIGNALYTICS

We bridge deep consulting and business understanding to quickly establish key objectives and challenges and then align these with strong data & technical skills.

Our methodology firstly extracts, integrates & generates insight but then also supports how to implement and operationalise.

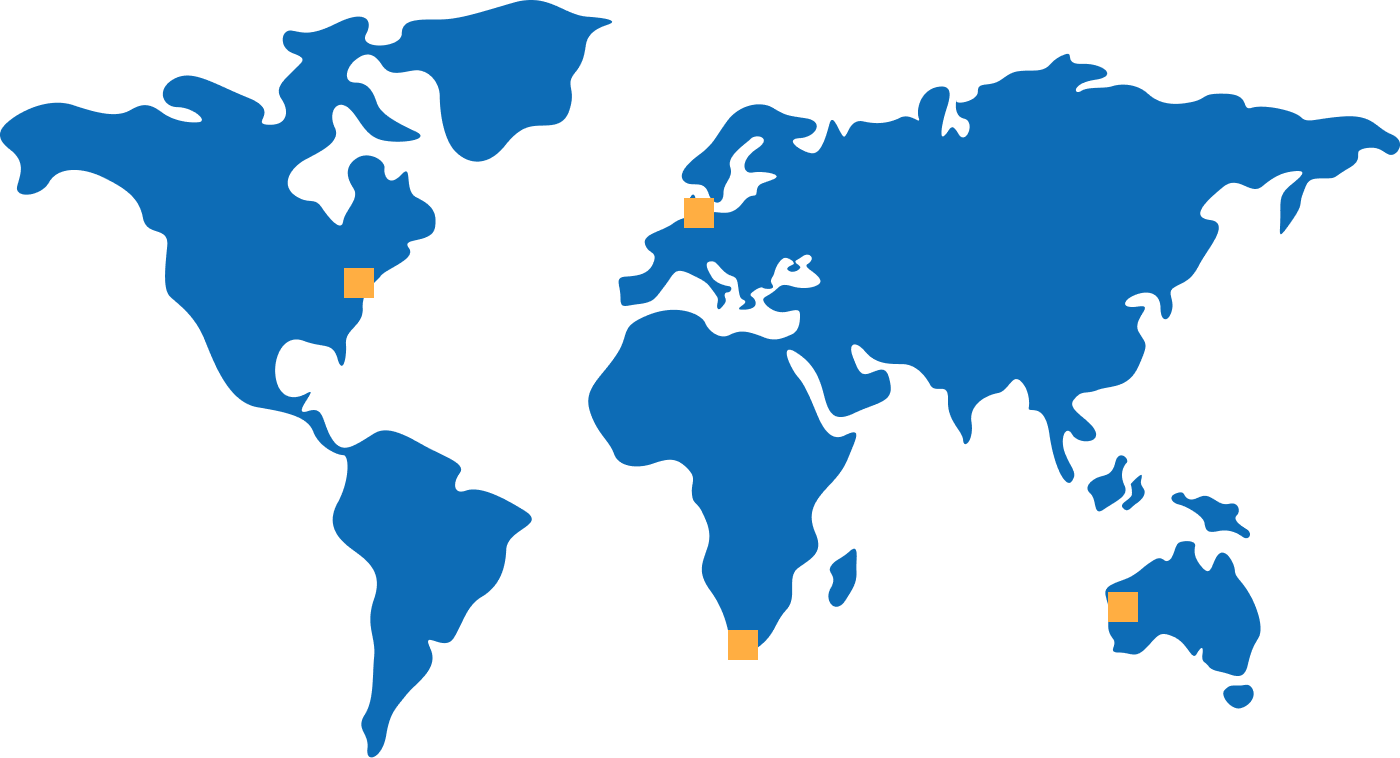

Operating wholly remotely is our long established way of working

Experience of delivering 100+ projects

Pragmatic, problem-solving entrepreneurialism